Money Can Buy Time - How Much Time Can You Buy?

In a world where time is our most precious resource, why do so many of us spend the best years of our lives working only to save for retirement?

In a world where time is our most precious resource, why do so many of us spend the best years of our lives working only to save for retirement?

I want to explore some ideas around money and time.

At the core, money can be used for more than buying things.

A concept we are well aware of. It's called retirement.

My question, however, is, why only use that time for retirement?

Let's dive into personal runway, retirement before retirement and investing in yourself.

Understanding this concept and knowing your finances can enable you to take a leap. It's not just having savings; it's also knowing that time is much more valuable than money.

Why? Time is limited!

How much time do you have?

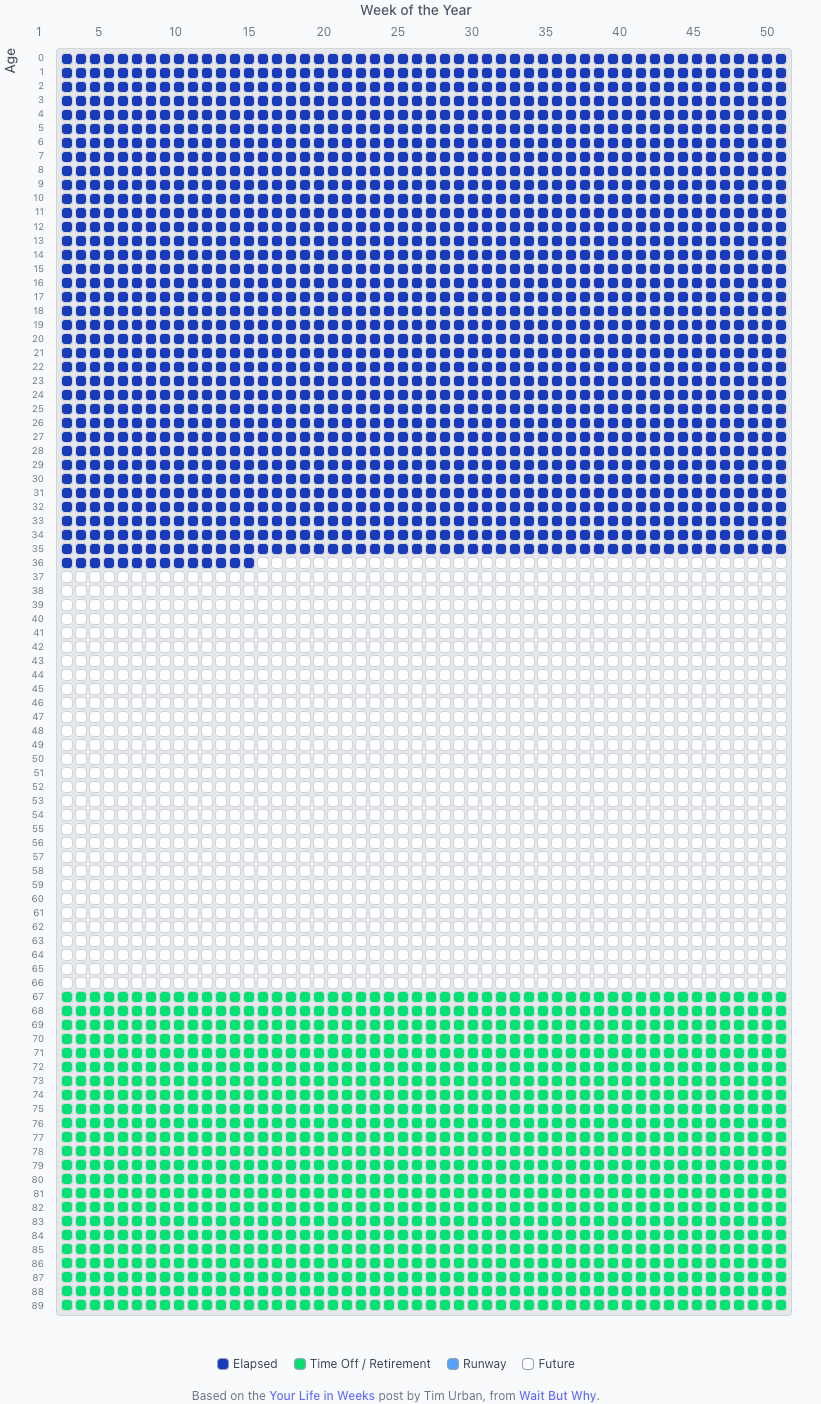

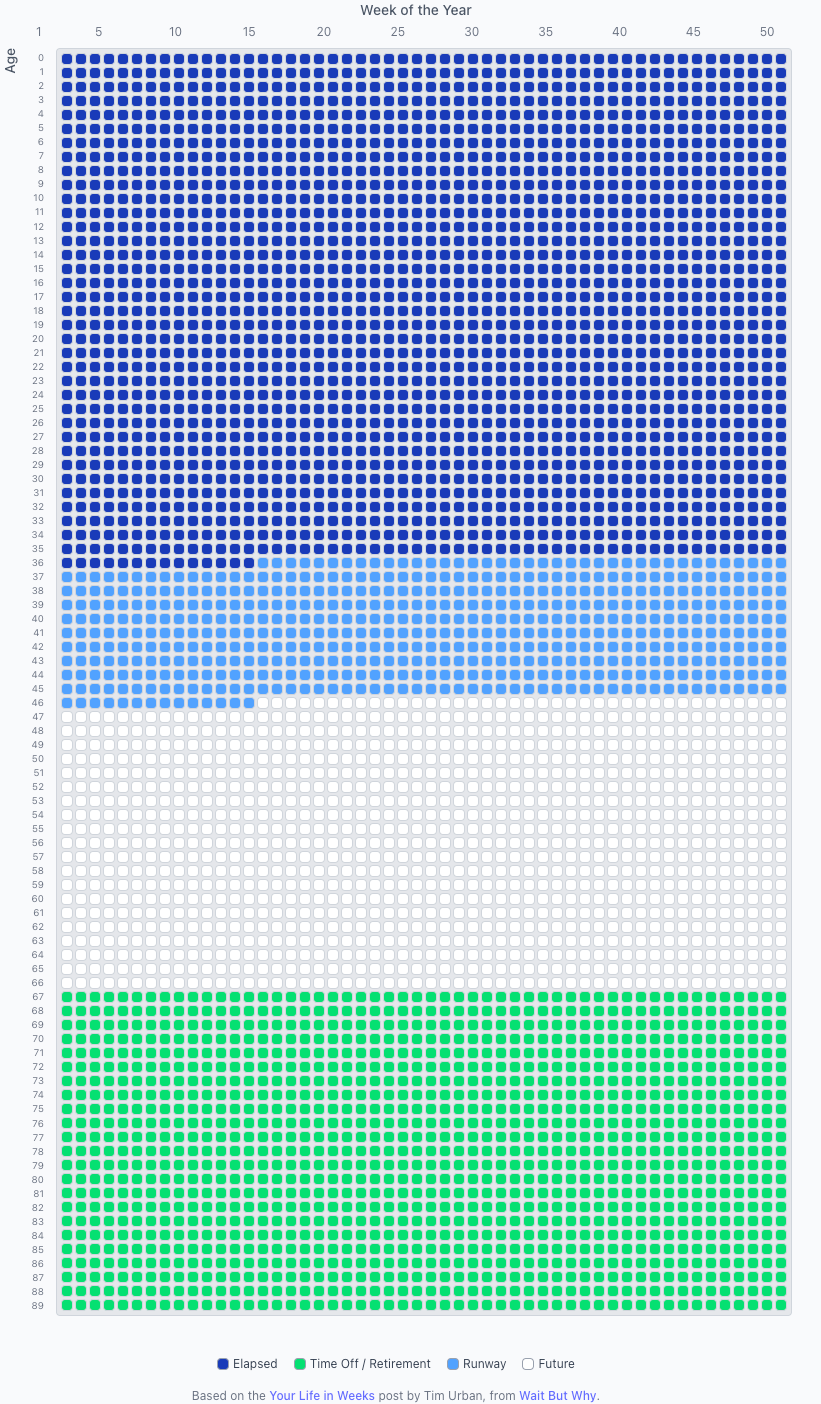

Tim Urban brilliantly displays the days of our lives as a set of squares. Colours indicate different phases of one's life (below in blue, is the elapsed time of my life and the usual retirement age for people my age).

What's obvious is that we spend most of our fit and healthy years working and then have a ton of time off when we are not that fit and healthy anymore.

We call that retirement.

In a way, we are already buying time. We save money during the work phase to buy time during the retirement phase.

(I built a little calculator based on Tim Urbans' diagram)

The above diagram shows my progress - more than a third "elapsed".

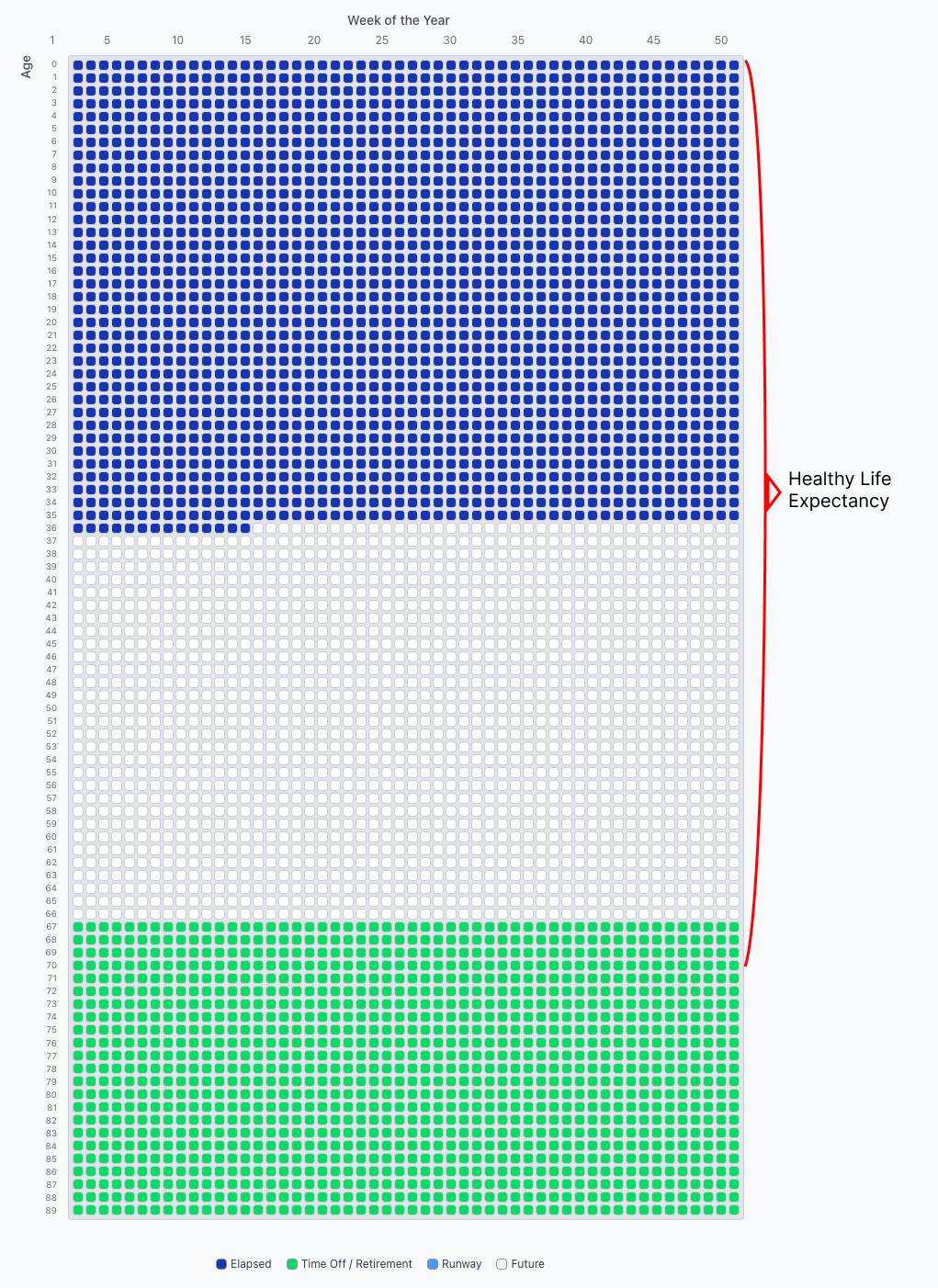

Let's overlay this with how healthy and fit a person is or their ability to spend time with their young kids or recover from a failed business.

Take HALE, healthy life expectancy, which is a statistic on a person's healthy life span.

Australians have a healthy life expectancy of ~70 years.

Add this to the diagram, and you'll see that statistically, you won't have much healthy time in your retirement.

(I built a little calculator based on Tim Urbans' diagram)

Additionally, statistics like these show that our kids spend the most time with us when they are young. If we have kids with 28, that gives us ~12 years before spending time with them starts decreasing rapidly.

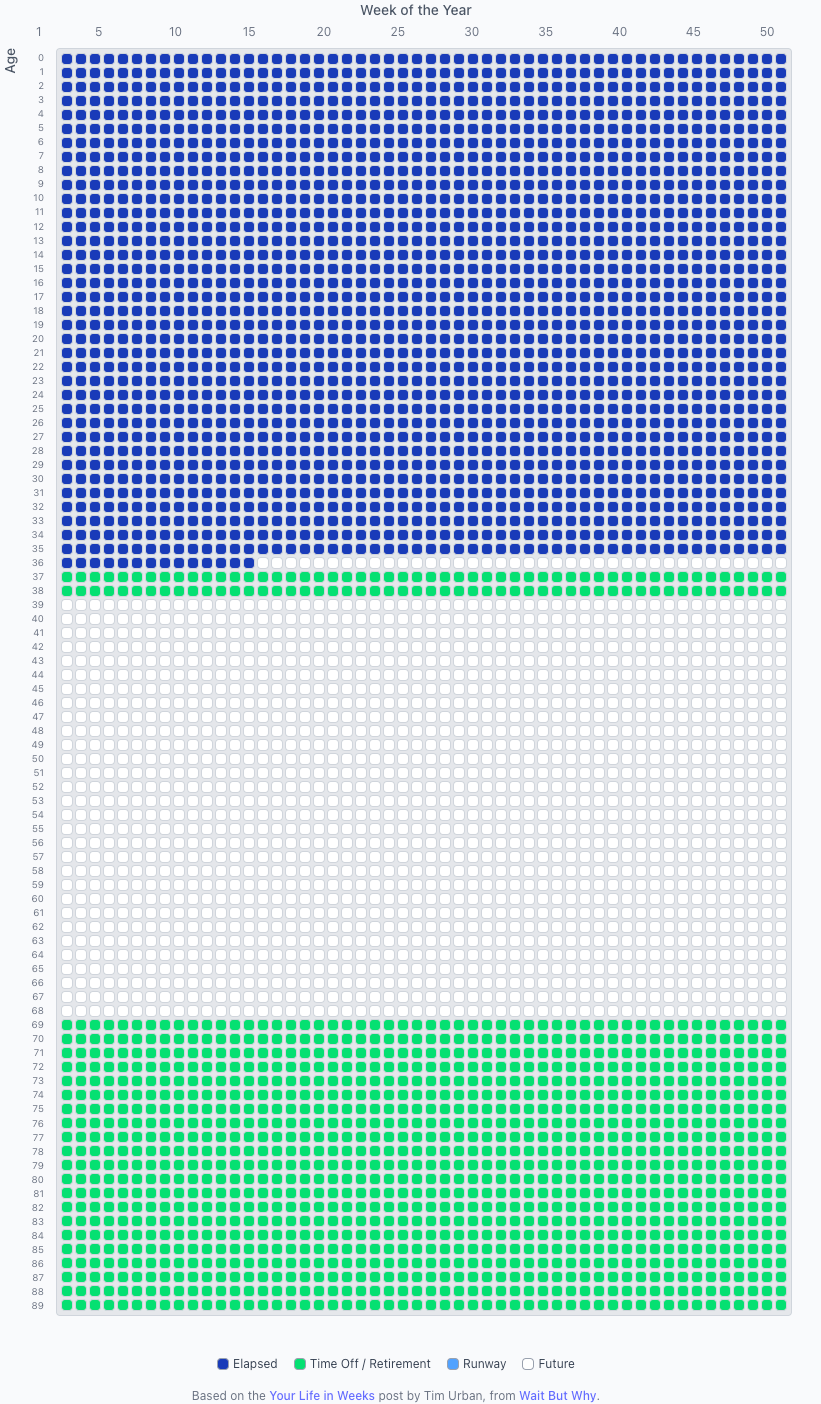

The obvious question, then, is: Why don't we pull some of that green retirement phase into the younger years?

It makes me think of my retired neighbours, who spend most of their day watching TV. They might want to do just that, but they may feel too old to do anything meaningful or exciting.

They likely spent their years working towards retirement, and when that day finally came, all pressure fell off their shoulders.

However, they might also have realised they were too old to do whatever they liked.

These are the moments when I think about my life and how I want to spend it.

I don’t want to wait until I'm 67 to start doing what I want. I’d rather do it now.

The Hamster Wheel

Germans save money in state-powered pension recycling machines, Australians invest in stocks, and many other countries simply encourage buying and paying off houses.

Today's life is built around working towards retirement, which often traps people in an endless work cycle.

There is nothing wrong with putting something aside for later. It's just that some overdo it to a degree that gets them into the hamster wheel (or the Rat Race).

Let's say you're too worried about not having enough when you're old, so you borrow money and buy a house.

That mortgage might get you into a situation where you have to keep working with no easy way out.

Many people are living above their means like this—mortgage or not.

By getting into this trap of spending too much, you lose your financial flexibility.

Being financially flexible means you are not tied to your mortgage or expensive lifestyle. You have enough money saved up to buy yourself time.

This does not mean you need to be rich.

It could simply mean you saved enough to quit your job and try something new for a few months.

How much you need and how much you can save depends on you.

Think of financial flexibility as a mini-retirement before you retire (if you need it, when you need it). Some might call it a sabbatical, but that often sounds like a long holiday to me.

Just use some of that retirement money right now. You can make up for it later. Who cares. Even if you need to retire a little later.

(I built a little calculator based on Tim Urbans' diagram)

Wait, but how?

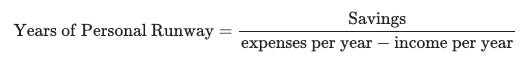

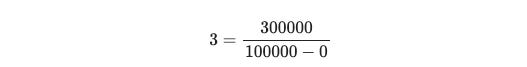

Let's put this "Money Can Buy You Time" thing into a tangible formula.

Let's say I have saved up to 300k, I earn nothing right now and spend about 100k per year.

I have a runway of three years.

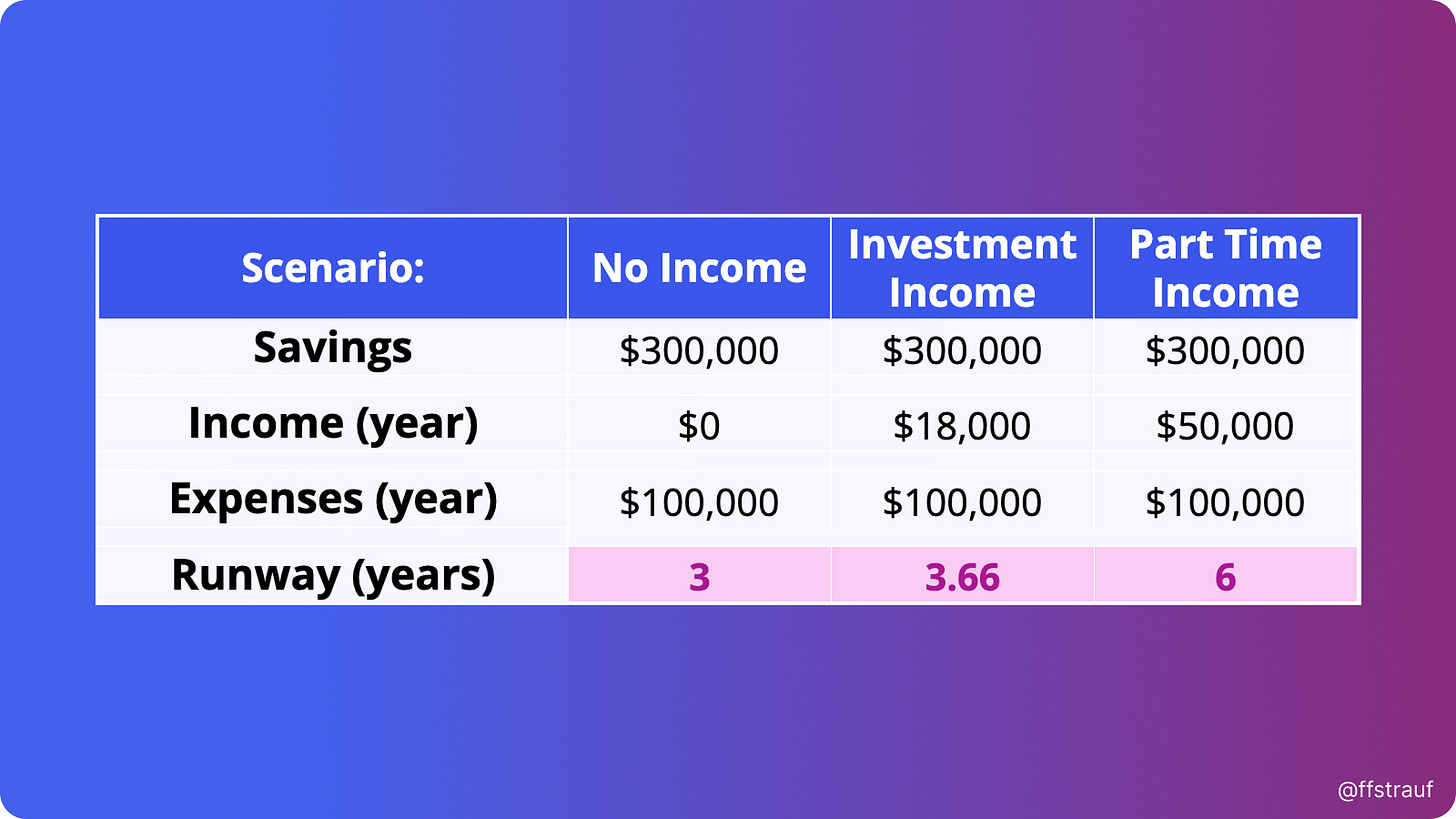

There are a thousand different variations of this. You could earn some income from investments or work part-time, which might greatly impact your runway. You could also not work at all.

Similarly, if you manage to spend less, your runway increases too.

It’s simple, and you can start tracking/calculating it easily in any Google Sheet. No need to meticulously count every cent, even if you just do some napkin math on your annual totals.

Startups have this very same concept. It’s called runway, too.

Personal Runway is a pretty cool metric.

Someone with lower savings can have a longer runway than someone with higher savings. Therefore, they also have higher financial flexibility.

If you make 500k a year but lease a Landcruiser, go on expensive holidays, and have a big house, your runway could be lower than that of someone who makes 100k a year and has a small apartment, no car, and a simple lifestyle.

There is no right or wrong here; you’ll have to find what works for you.

I lived in a bus, so what can go wrong?

What to do with the time?

Buying time is still easier said than done.

Even if you have saved a lot and invested well, taking a leap and starting to use these savings is daunting.

After leaving my last job, I'm doing this right now. I'm confident it will lead to something, and at least I will be learning a lot.

You could do it like my neighbours and spend a year sitting on the couch, watching TV. Or you could travel, start a business, or learn something you’re interested in and passionate about.

Bill Perkins, in Die with Zero, explains this by arguing that you should spend your money early on great life experiences instead of waiting until you’re old and can no longer spend it.

Remember: Money is replenishable; time is not.

So, while you might lose 100k taking a year off, you’ve at least spent your time how you liked.

You will likely make that 100k back.

You most certainly won't get that year back.