An enterprising tourist encounters a contented fisherman dozing by his boat. The tourist, embodying a capitalistic mindset, proceeds to lecture the fisherman on how he could expand his fishing operation—working longer, buying more boats, hiring staff, building a cannery, and eventually becoming wealthy enough to retire and enjoy a relaxed life by the sea. The fisherman calmly listens and then points out that he is already living that desired relaxed life in the present, without the decades of stressful striving

Whenever I read this story, I can't help but think how true it is and how well it reflects our own lives.

Most of us will likely be thinking more like that businessman. Stressfully striving towards later enjoyment.

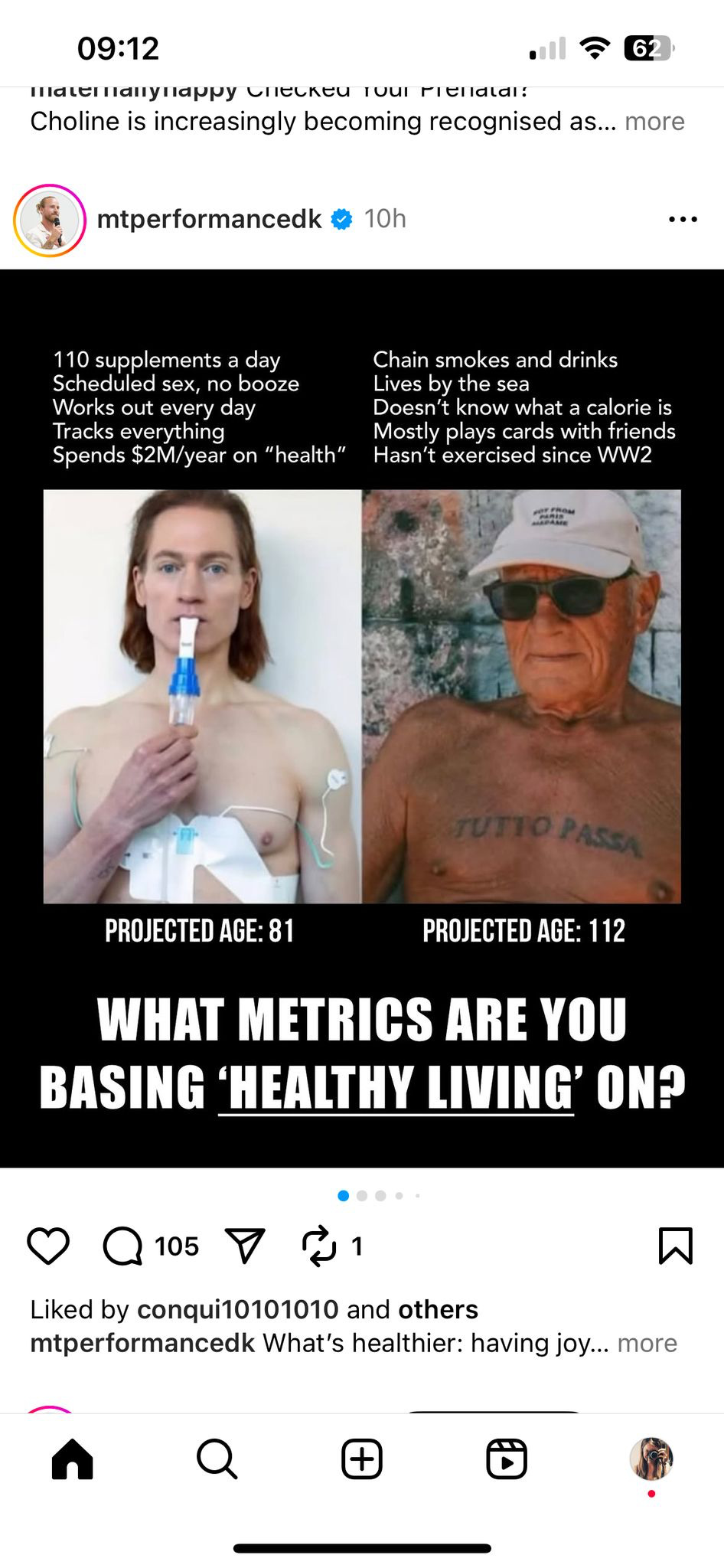

Too stressed, like Bryan Johnson walking outside with an umbrella to avoid the sun aging his skin.

Too stressed to take a year off, as it might hurt your career progression

Too stressed to downgrade your career to do something more fun.

There have been moments in my life when I have done the same. I moved to Cyprus partially because of the taxes (also to be closer to the family), without checking too much about whether I would like it. The greed for these lower taxes, higher income, etc., partially influenced a poor life decision that caused me a lot of stress. In hindsight, I probably should have stayed in Australia and enjoyed the good life there.

Not always is the stressful striving worth it; we often lose sight of what is really important.

Barking Up The Wrong Tree

"Everything is a trade-off... Cyprus comes with low taxes, hot summers, and crazy bureaucracy"

In my expat series, I explored the idea that everything in life is a tradeoff, even the countries you might move to.

No country is perfect, but I see many people chasing that dream of moving to the UAE for the money, and I can't help but think of the fisherman (and my own mistakes).

Yeah, you will get a lot more money and pay no taxes. Still, you also move to an incredibly hot country, where life is lived indoors for part of the year, where the culture and values are very different and where you will likely spend a lot of time working hard and being stressed.

Ironically, often with the goal of returning to a relaxed life.

What if you just stayed home? Maybe you downsized on your big house and fancy car and realised that you're still quite happy.

I've recently posted on Reddit my mistakes and lessons learned from my journey through personal finance, and one comment that struck me the most was a guy who highlighted not to stress too much about it all.

As pointed out, being less stressed doesn't mean you should travel to Europe on your credit card, but you need to strike a balance.

Avoiding too much of the stressful striving, but having some cushion to enjoy life.

Finding Balance

Most people can't stop working completely and live in a bus, and most people don't want to grind 80/h a week to own a mansion once they retire.

We all know people on both sides of the spectrum: those who do too little and enjoy life too much, and those who strive way too stressfully in the hope of enjoying later.

Some people might have no choice but to temporarily grind as it's more of a fight for survival. In many cases though, people will pay way too much for shiny things, live beyond their means or don't realise their potential.

Regardless of where you stand, it's always useful to take stock.

(source)

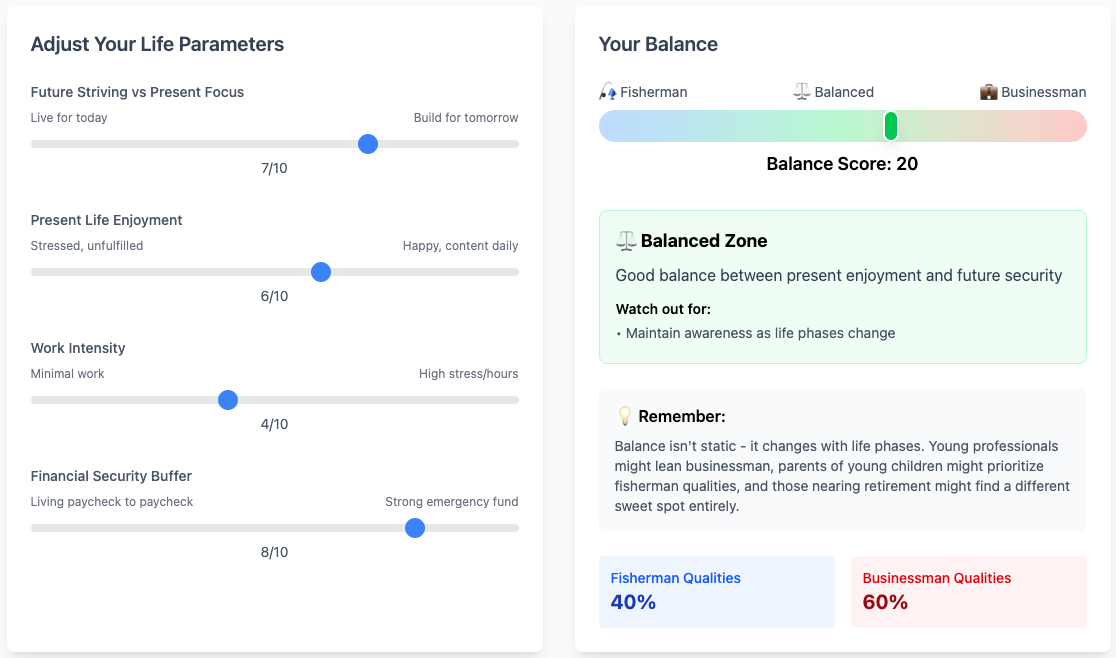

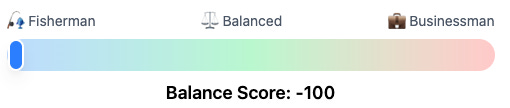

Things to look out for are how happy or stressed you are and how much you are looking into the future vs. living in the moment. This little calculator will give you a rough idea.

There are several signs that indicate you might be going too far on either side of the spectrum.

(source)

Signs you are too far on the businessman side:

You abandoned your exercise routine due to "lack of time"

You miss out on important family events for work

You're unable to spend money on experiences without guilt

You measure self-worth entirely by career achievements

(source)

Signs you are too far on the fisherman side:

You live paycheck to paycheck by choice, not circumstance

"She'll be right" is your financial plan

Your children are missing opportunities due to finances

You turn down growth opportunities

What these questions ultimately show about the businessman and the fisherman is that they both value time differently.

The fisherman values time in the present; he enjoys it right now, not worrying too much about what will happen in the future.

The businessman values time in the future; he sacrifices time now to enjoy later.

The big questions for most people will likely be, how much do i need to lean towards the businessman side.

TLDR: I don't have an answer, but I can help to quantify things.

A Tangible Balance

Quantifying is easier than most people think.

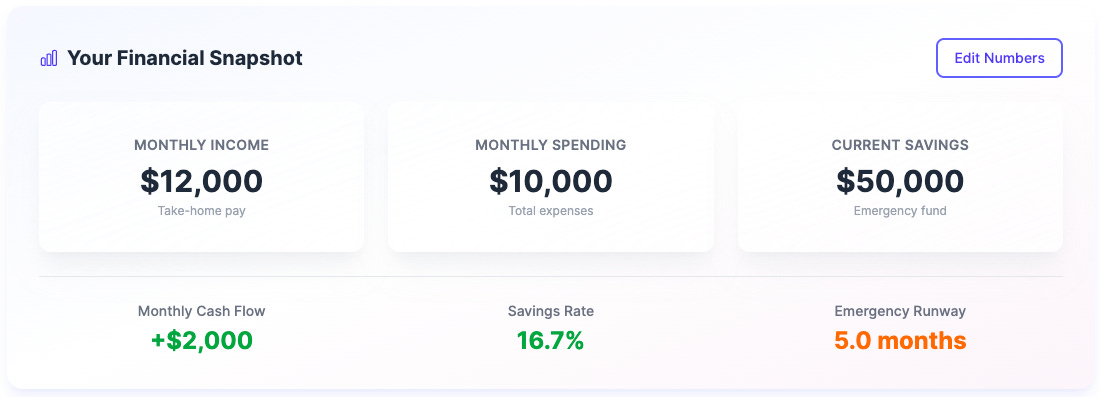

(source)

I'd say you need to be aware of:

your cash flow (what you spend, what you earn)

savings rate (how much of what you have left do you invest)

savings (how much do you already have)

These are great as they let you draw simple conclusions immediately. (If you don’t track these yet, a simple expense tool that auto-categorizes and shows runway helps keep the numbers honest.)

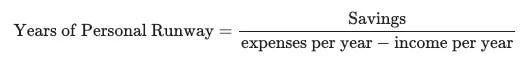

Take runway, a parameter the fisherman intuitively would be aware of, as I assume, on that extreme end of the spectrum, he will use the runway as soon as he has it. Valuing his time right now.

In short, the fisherman will likely only work if he needs to. His entire life is likely also geared towards maximising that runway via low expenses.

We met this family of five while travelling. They had been living in a bus for years (their Instagram sure looks like they're having a great time). They would typically stay at a location for a couple of months, depending on where they could find work. That work would stock up their runway before they hit the road again for some time without working.

Very adventurous.

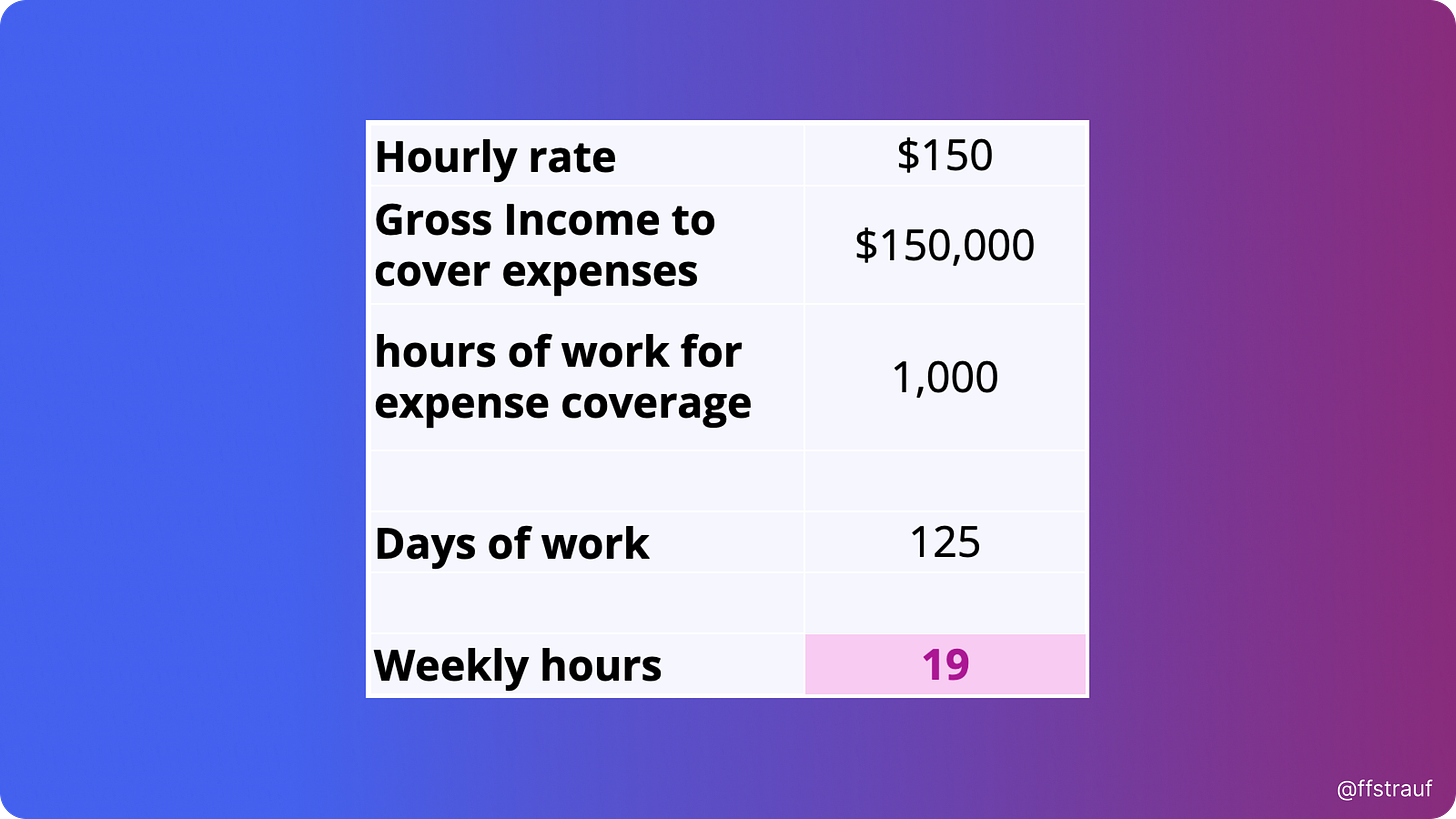

Something less risky could be finding a consulting gig with a nice hourly rate and working backwards from your annual expenses. Say you need a gross income of $150,000, and your hourly rate is $150. Then you need 1000 hours, or 19 hours per week.

Now that's obviously all deep in fisherman territory, and if you believe the jungle will always provide, that's a great way to approach life and maximise for enjoyment.

But that's not a viable strategy for most. To balance things, it might be reasonable to keep the savings rate up a little, to let your investments work for you later or provide some safety.

Here, however, I can see how this quickly spirals into work, work, work, save, save, save, and people grinding away their lives.

How much runway you should have depends very much on your stage in life. Do you have kids? Are you young and can take risks? Are you able to downscale your cost of living?

Depending on this, you might be fine with six months or want to be extra sure and have two years' worth of expenses invested.

Running the numbers won't give you all the answers, but it will give some clarity.

Money is Replenishable; Time is not

At the end of the day, you need to decide if you want to be more like the fisherman or more like the businessman. The above metrics of runway, hourly rate and cashflow are great to get a sense towards which side you might want to lean.

Everyone's ultimate scarce resource is time. If you are sinking a lot of time into something, it better have a good hourly rate, a great potential future hourly rate or be something you love doing.

"Money is replenishable; time is not"

Deep down the fisherman knows that and lives his life accordingly, that's why the story is so eye opening to most of us. Society today seems to turn us into businessmen, living beyond our means stuck in the hamster wheel.

Obviously not everyone is able to downsize, work less or take time off, but the fisherman doesn't seem to be someone who is particularly wealthy and seems to be getting along quite well. The story isn't pure fiction either. I've seen plenty of these folks around the world and think there is a lot to learn from them.

I'll leave you with another one from Bryan Johnson: