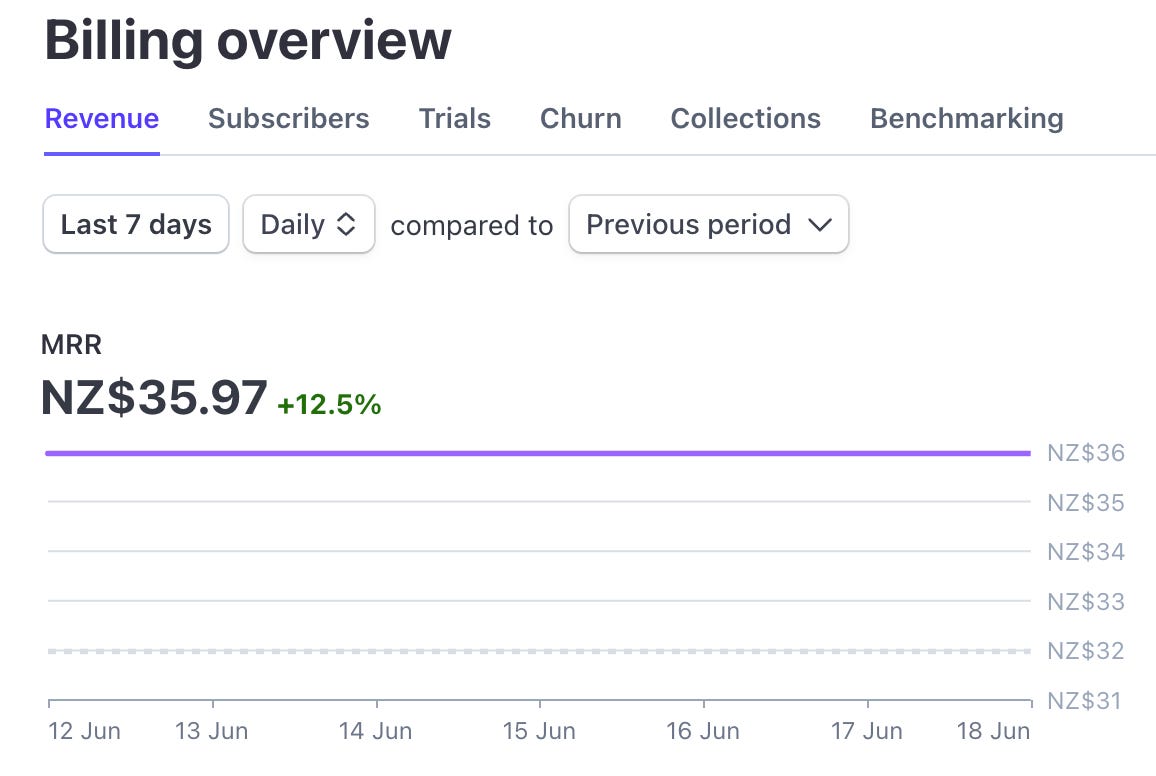

How I got to $35 MRR in 18 months of building a personal finance app.

Thirty-five dollars monthly recurring revenue—not $35K, not $35M. Just $35.

Here's what 18 months of grinding actually looks like, and the expensive lessons I learned along the way.

This is a sort of antidote to the usual how I got to $1M MRR success stories, which might be inspiring but are very much out of reach and hide the realities of what it means to grind.

I think a lot of founders who have been through this can relate.

People get the same wrong impression from Instagram and Twitter these days. The impression that everyone else is killing it. If you ask me, that's most likely not the case. Everyone struggles.

I want to reflect on my personal finance journey and how it has led me to sink a ton of time into building an app, trying to find if someone else might also be interested in it (aka finding product market fit).

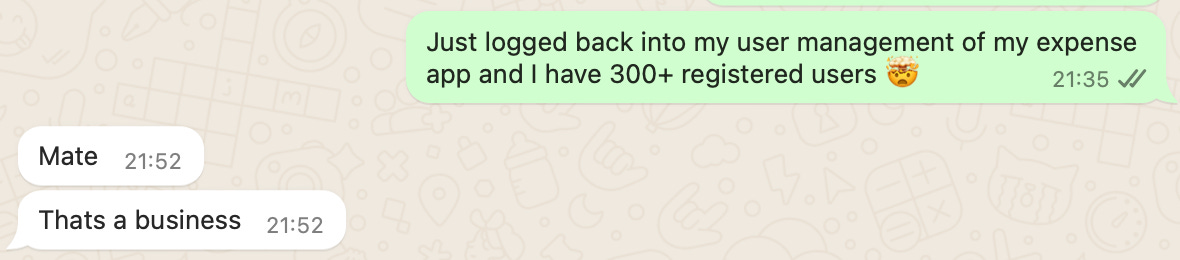

Two years ago, I turned my personal Google Sheet budget tracker into a web app. After working at Forgd for a year, I returned to find 300+ people had signed up.

Pretty excited, I thought I could get this thing going.

It wasn't quite as easy, though.

Building Better Features Wasn't Enough

To simplify things, I thought I'd build a simple Google Sheets extension that works from my template and automatically categorises bank transactions based on a user's past transactions.

Full of excitement, I built the extension and hustled with Google to get it listed on the app store.

It looked a bit like this:

The goal was to send out a big bang announcement to the 300+ people who had signed up and tell them about this exciting new app, followed by a marketing campaign on Reddit, Twitter, ProductHunt, etc.

A total of five people tried out the app, and nobody converted past the trial.

That 300+ audience likely wasn't as warm as I initially thought.

But something must have gotten them to visit the site.

I kept building and improving the flow, making the software more robust and the flow easier, but still didn't get any traction.

At that point, I thought, "Yeah, maybe people aren't that interested in automatic transaction categorisation." LunchMoney, Monarch Money, and Tiller are all big in this space, but they only use rules.

Rules mean you define things like:

IF description == ALDI, then category = Groceries

IF description == UBER, then category = Transport

I was doing this much smarter, and yet nobody cared.

My takeaway is that even if you build something technically superior, distribution and user education matter more than features.

Distribution was my next focus, but my old email list wasn't any good.

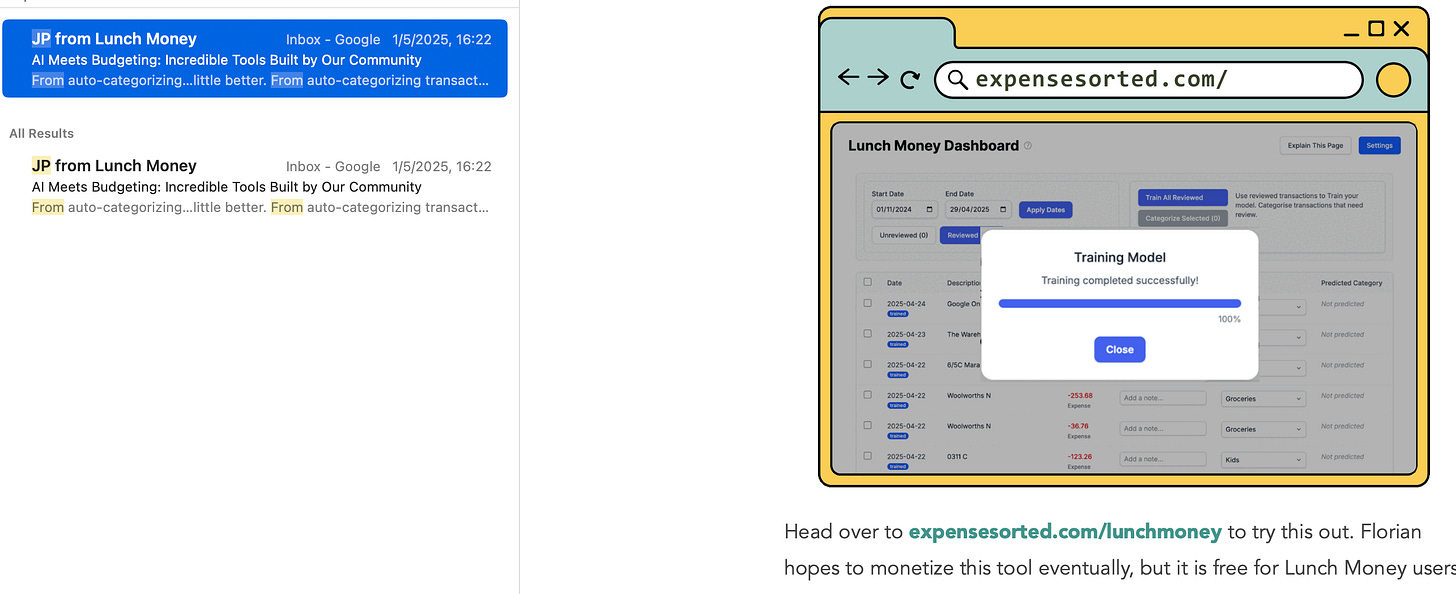

So I settled on LunchMoney, which has a large community and uses old rules. A perfect fit for me to optimise?

Wrong Channel, Same Problem

LunchMoney has an API that allows an app like mine to categorise transactions before sending results back to LunchMoney.

I quickly built an integration, wrapped it into a simple app, and advertised it on their Discord.

Only a few people became interested, though. Even after being featured in the Lunch Money monthly newsletter, only a few people signed up to try out the app, but nobody really stuck around.

Maybe what I'm offering is not a big enough problem to solve, I thought at that point.

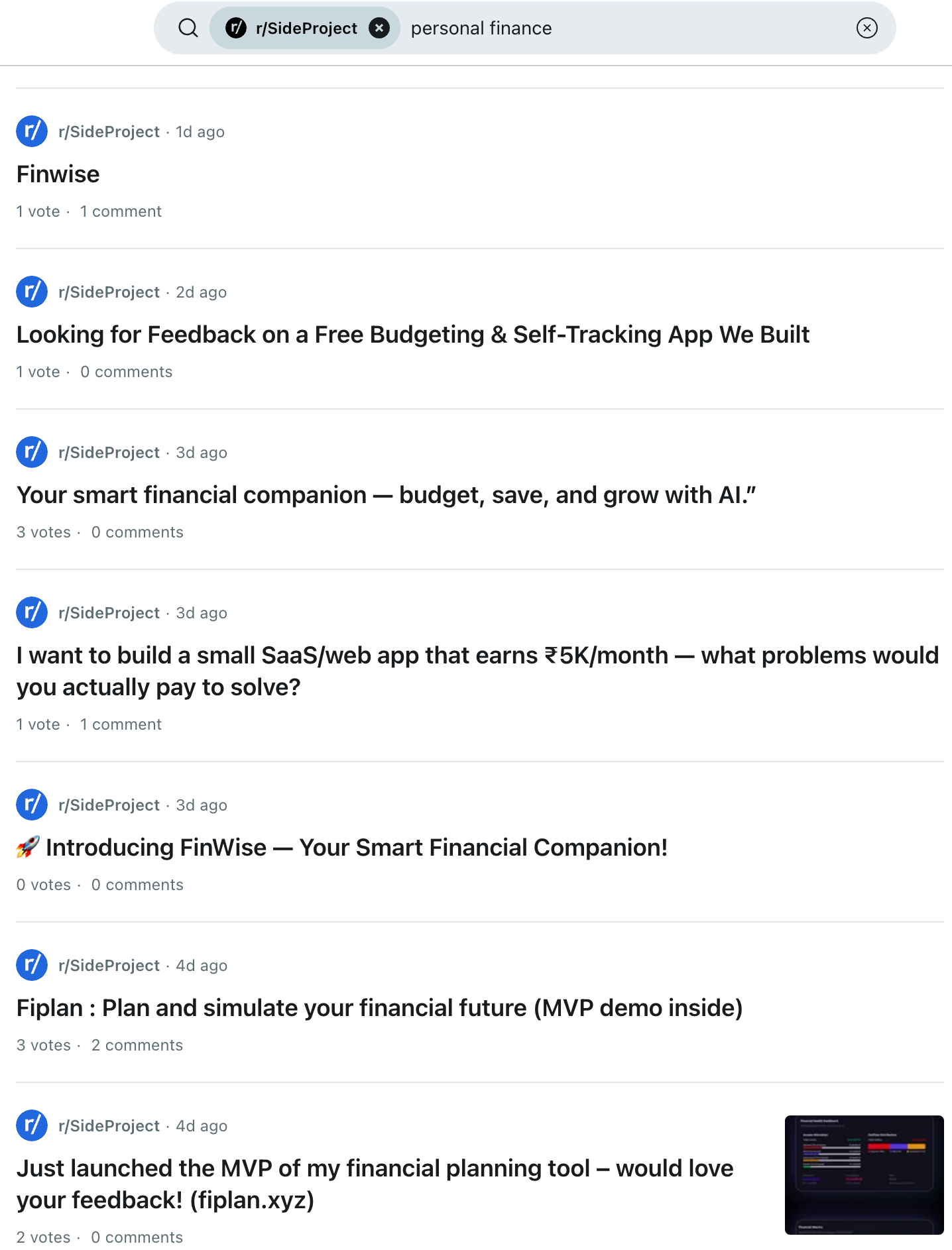

On top of that, the competition is quite fierce, and with AI, it is only getting stronger. Just look at r/SideProject, and you'll find 345 different personal finance apps launched daily.

But then I think about the pain of tracking my own expenses every month: downloading bank CSVs, transforming them to Google Sheets, categorising them, and then fiddling with that newfound data in my analytics.

I've tried different apps, and they all feel clumsy, expensive, lacking good analytics and smartness.

Maybe I'm just not properly addressing the problem?

People don't seem to care about the process or how good it is; they care about the result. It needs to be easy to get there.

So, my approach of reading, training, categorising, and saving transactions was something everybody hated doing, no matter how smart.

My newsletter placement didn't increase retention—people tried stuff but didn't stick. It likely didn't solve a big enough problem or address the right problem.

There is clearly a difference between "this is cool" and "I will pay for this" or "I need this".

Solving the Wrong Problem

When I visit Reddit, I see many personal finance communities, and all seem to revolve around the same recurring questions: How and where to save, how to track expenses, budget, and invest the savings.

On top of that, Monarch Money raised 75m in Series B. That's a signal that there is some market here.

Maybe nobody cares about the actual categorisation, but there is interest in answering the above questions and making people more aware of their financial habits.

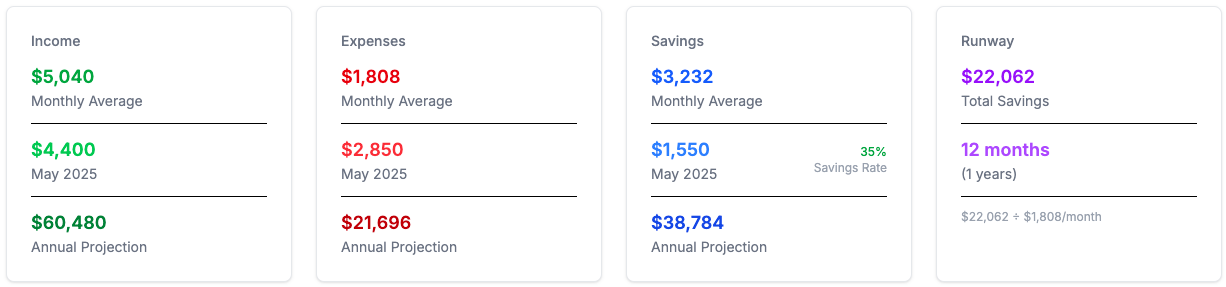

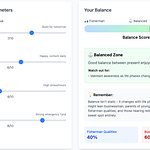

The metrics I produce with my monthly flow and the conclusions I draw from them are exactly that—they worked for me.

So, my next iteration now is to start with just that—the stats I want and a super simple pathway to get there (at least that's what I think).

I'll stick to Google Sheets, which has become my little niche compared to all these other apps. I love controlling my data without dependency on some other service and the flexibility it gives.

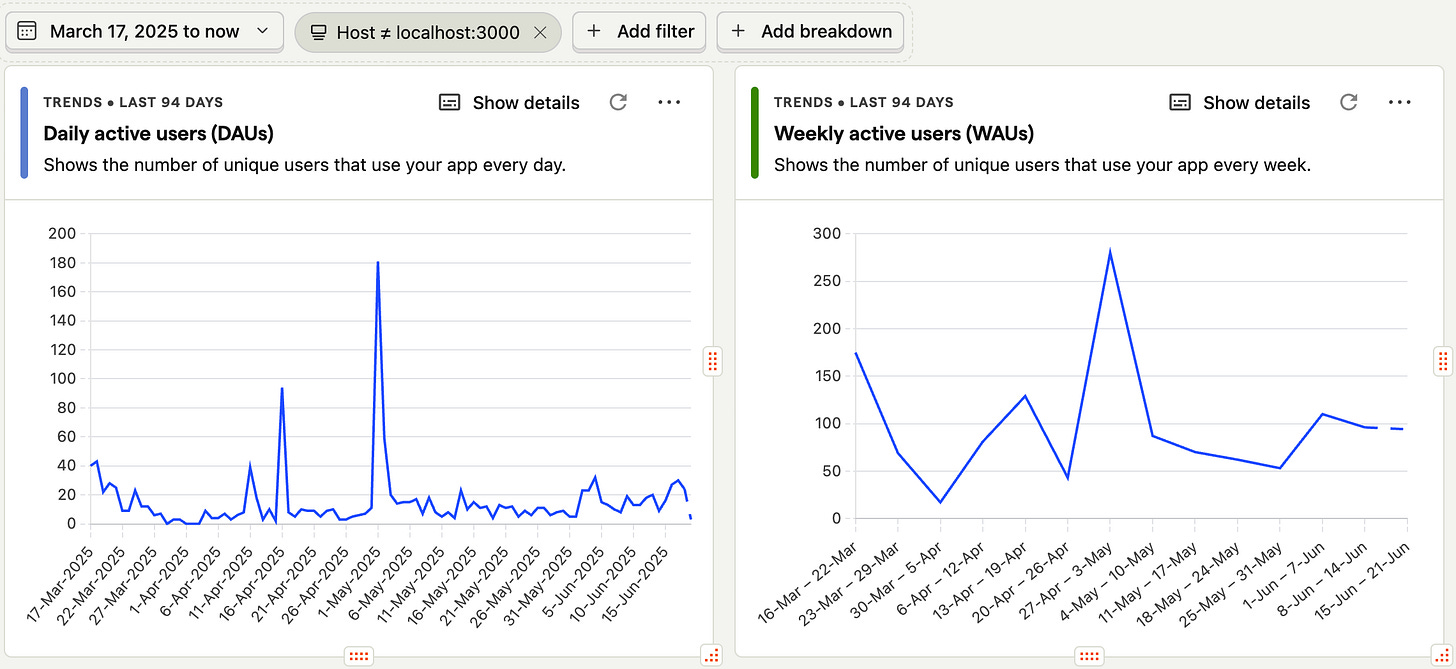

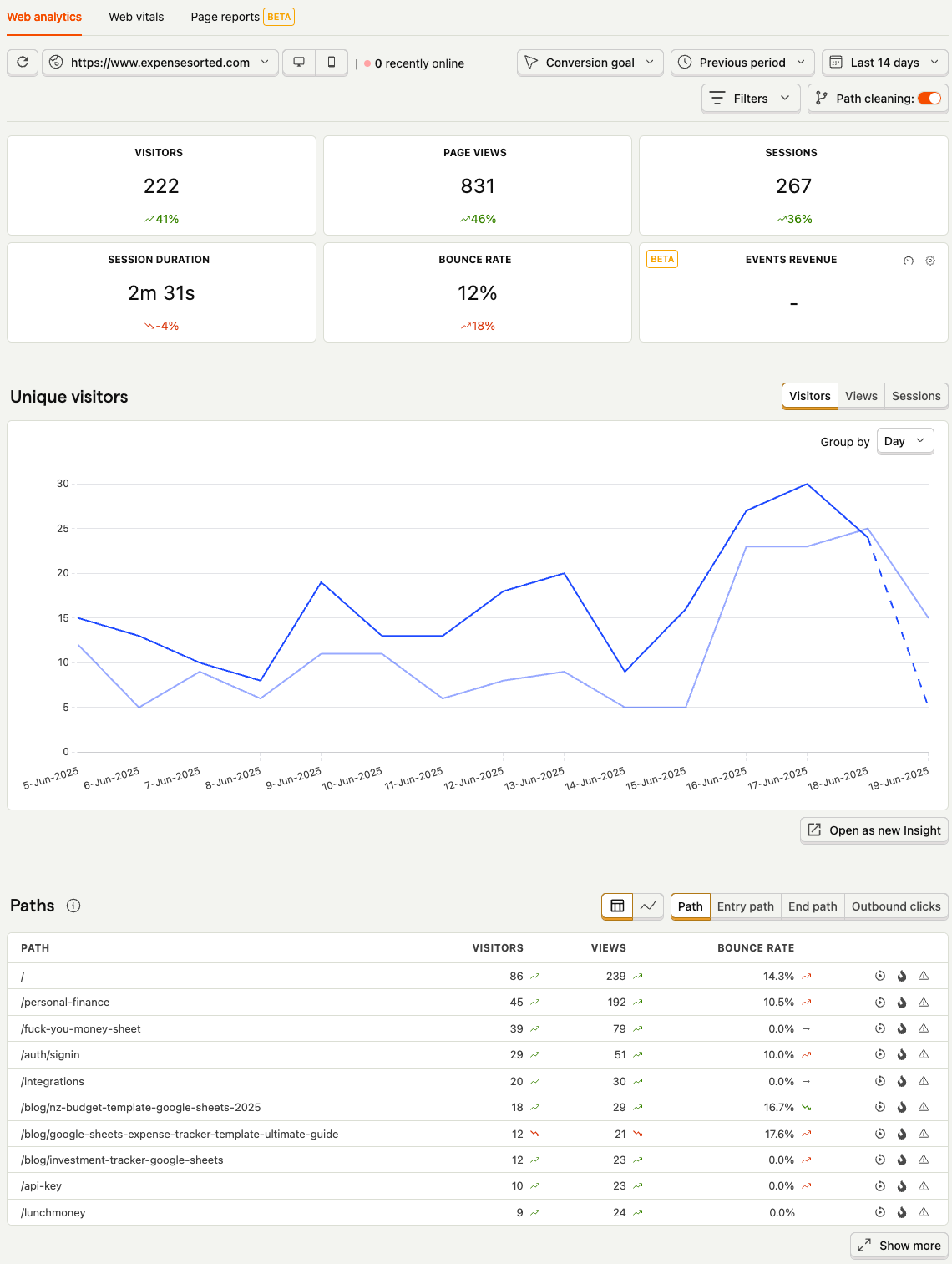

Now, I guess it's time to sell and wait to see if I get any traction. I'm still getting "decent" traffic.

I don't want to spend money (just time) and thus won't advertise. B2C seems quite tough to win attention, especially when competing against companies that just raised 75m.

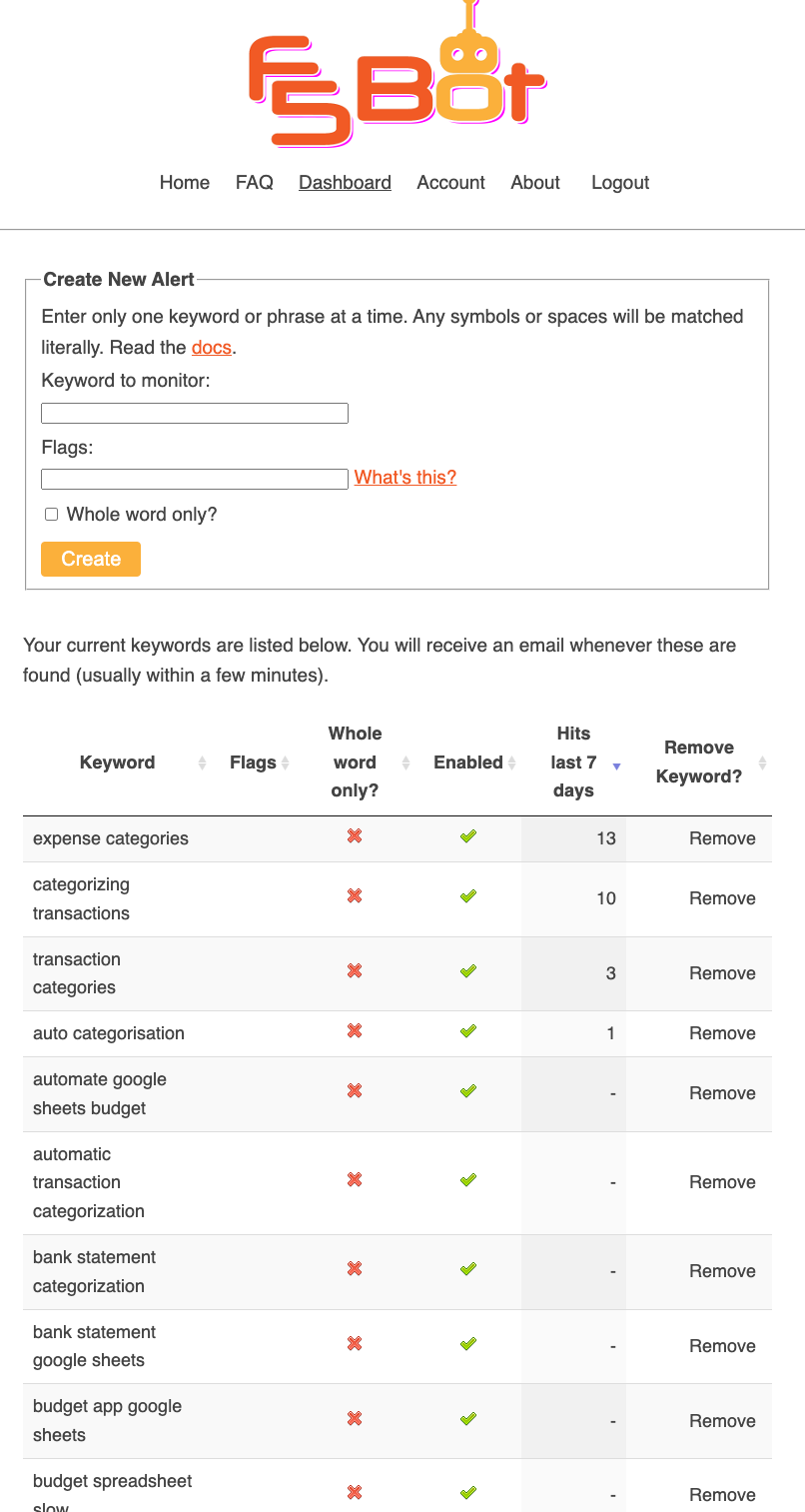

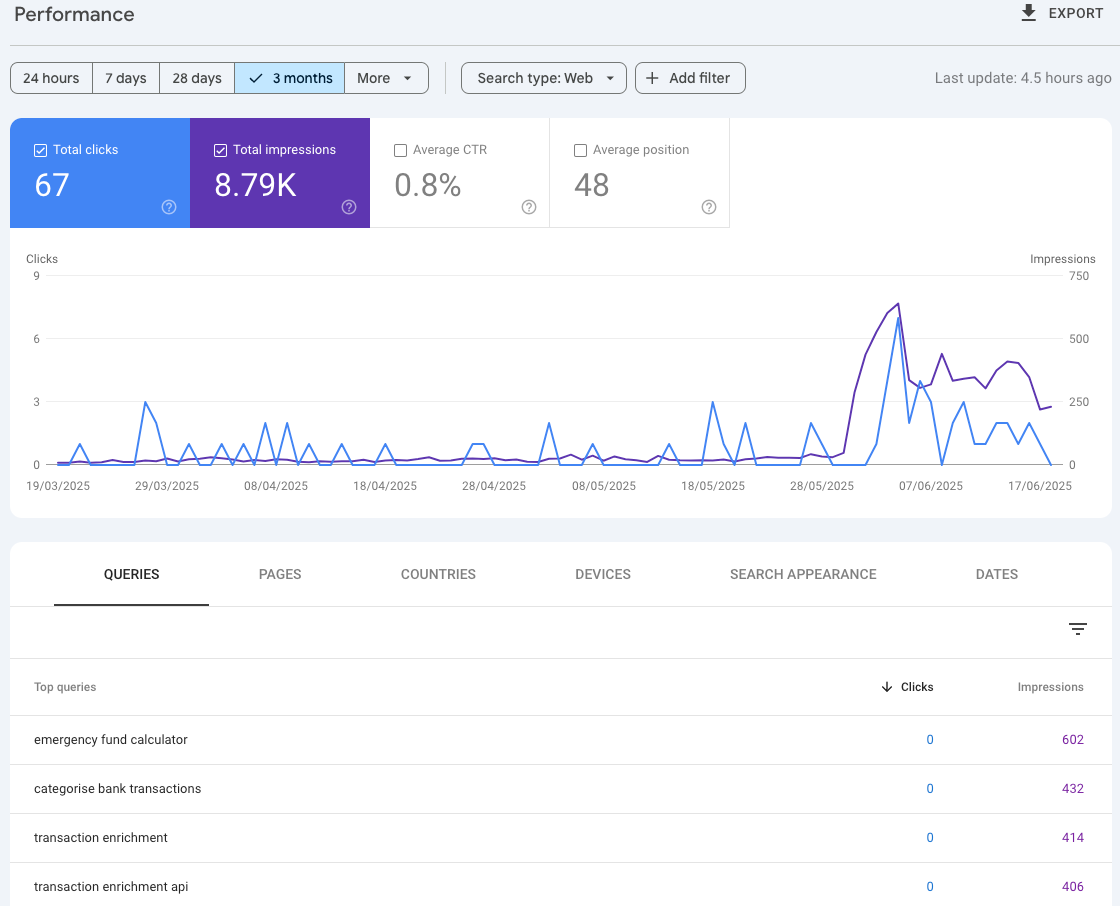

I've been posting Reddit replies via F5Bot (you get an email whenever a keyword you are tracking is mentioned and can reply) and boosting SEO—I've outlined here how I create blog posts for certain keywords and have been really improving my stats.

Keep Learning

I still don't know if I'm building something people want or only solving my specific problem. Maybe that's the point - you don't know until you know.

If you're reading this and thinking, "This sounds exactly like my journey," you're not alone. Many will be grinding in the $35 MRR range, not the $350K range you see in success stories.

If this makes you think twice about starting your project, don't let it discourage you.

Every failed experiment teaches you something. Sometimes it's about your market, sometimes about your approach, sometimes about yourself.

The difference between giving up and breaking through might just be one more pivot. Or it might be knowing when to quit and apply these lessons to something else.

$35 MRR isn't much, but it's $35 more than most side projects ever make. For now, that's enough to keep me curious about what the next iteration might bring.

Current iteration: expensesorted.com if you're curious.